The fall of 2024 has rewritten the defining current for Canada’s real estate market, swimming against the usual seasonal slowdown. With sales numbers climbing and interest rate cuts driving buyer activity, the months of October, and November brought renewed energy to the housing market across Canada.

Real Estate in British Columbia has mirrored this trend – with good number of sales in the fall months, it appears the buyers are back in the market. Known for its stunning natural landscapes, thriving economy, high quality of life, and its diverse environment, British Columbia has long been one of the most sought-after provinces in the country. The province’s growing reputation as a hub for technology, film, and green industries, combined with its mild climate, continues to attract people from across Canada and around the world, contributing to its population growth and increasing demand for housing. In spite of having some of the highest numbers when it comes to average prices of homes, British Columbia residential units market has seen remarkable growth in the last two months.

Harshvardhan Singh, Manager Business Development at The Maple Realty shares, “It’s been amazing to see BC’s housing market so active this fall. October really kicked things off, and with more inventory and lower interest rates, it’s clear that buyers were not interested in waiting for spring to make their move.” Reflected in the numbers for the season, the Fall housing market defied expectations, with October leading the way in a surge of activity and November holding steady with strong year-over-year gains. It’s a clear sign that buyers are seizing the moment in an evolving market.

So what exactly has happened for the buyers looking for homes in British Columbia in September – November? Let’s find out.

The balance of September, the Surge of October, the Resilience of November.

The market in September saw lower sales numbers in comparison to August 2024, however, the overall average home prices still saw an increase in the month, along with great year-to-date totals. This drop was anticipated due to seasonal variation with the onset of fall. However, with new listings coming into the market, along with the existing homes for sale on the active listings, the Sales to Active Listings (SALR) remained at around 13%.

Now, with October 2024, the impacts of the rate cuts by the Bank of Canada became evident as numerous buyers chose to finalize their home purchases and sales jumped to over 7,000 with SALR of almost 18%. October saw very significant numbers in “clearing out the stock” so to speak. The average prices also saw a jump between September and October from approximately CAD 940k to around CAD 970k. These sales increased by around 27% from September 2024 with a 33% jump year-over-year.

You would think that November probably “cooled off” and in comparison, to October – it did. With average home prices reaching almost CAD 980k, the number of sales dropped by almost 18% in comparison to October with sales of approximately 5800 units. However, the housing market of British Columbia stayed resilient in November. Although they declined month over month, home sales activity saw an increase of nearly 26% year-over-year and a 5% growth from September 2024. In other words, the buyer’s quest for finding their homes was still going strong in November.

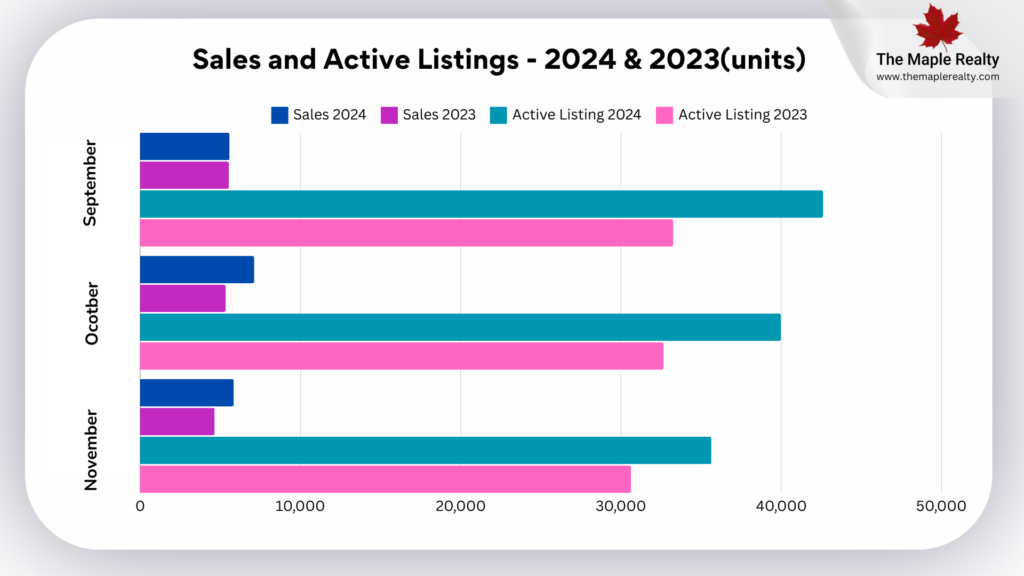

Let’s quickly compare total sales and active listings for September, October, and November in 2023 and 2024. Despite new listings being added, overall active listings in October 2024 declined by nearly 6% month-over-month and then dropped another 10% month-over-month in November 2024, highlighting strong buyer activity.

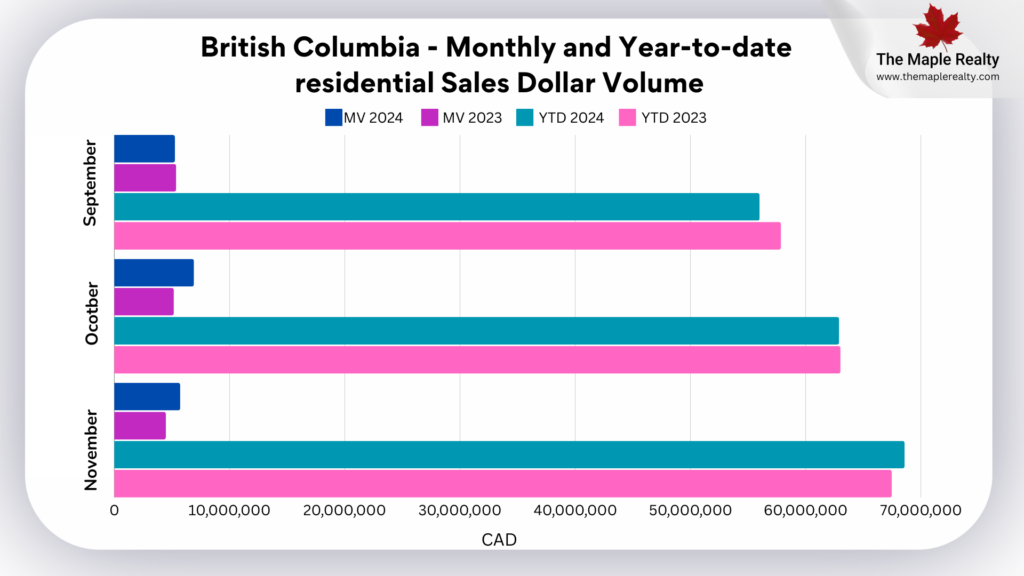

Let’s also see how this buyer activity reflected onto the total monthly sales amounts (CAD) and the year-to-date (YTD in CAD) amounts. Although September numbers for year-to-date were noticeably less for 2024 in comparison to the previous year, increased sales in October-November have contributed to the year-to-date values to increase by nearly 2% year over year in November – a direct indicator of the sales from the last 2 months.

So, why does this seem like an early Christmas gift?

The winter months are usually slower for both buyers and sellers in the housing market. While the Bank of Canada’s interest rate cuts were expected to stimulate sales activity, the substantial surge in transactions during the typically low-activity months of September to November came as an unexpected development. With the high sales numbers, and a balanced number of new listings on the market, it seems that the market is not just active but is gearing up for a great closeout for 2024 and an active start to 2025.

Another reason for greater sales is the higher inventory on the market. As in the Sales and Active Listings figure, the active listings grew year-over year for all three months mentioned here. With added benefits of interest rate cuts and the availability of stock, the market conditions aligned perfectly for buyers to become active.

Now, let’s shift our focus a little and look to

British Columbia and its different regions for their respective growth.

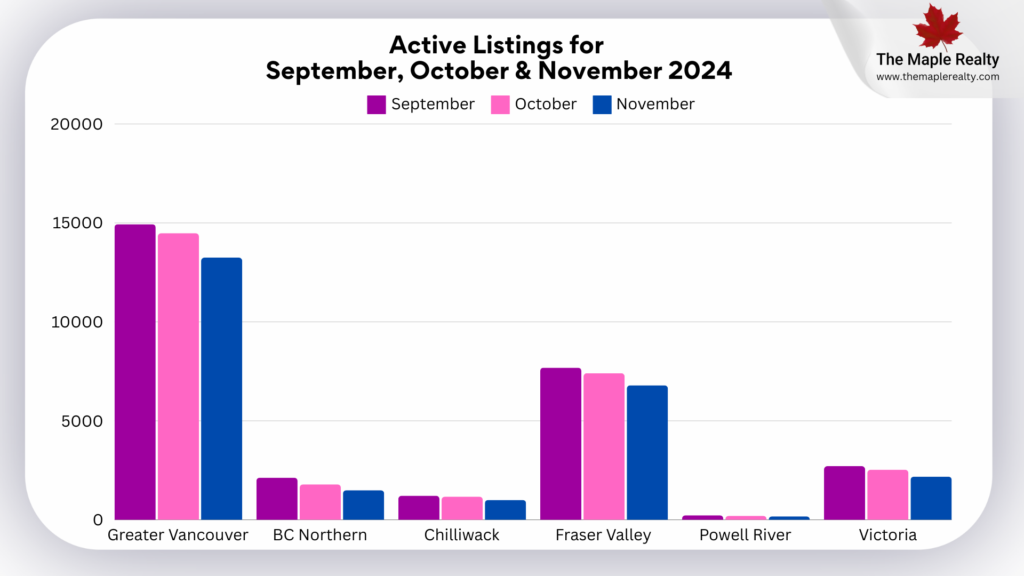

Despite the addition of new listings, the Province has seen a notable decline in active listings in regions during October and November 2024.

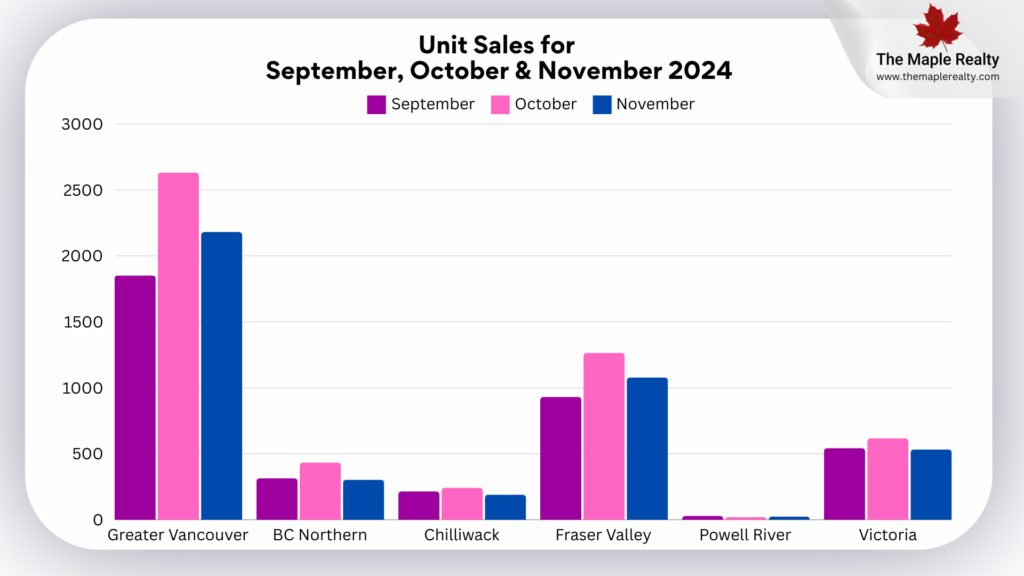

Let’s check out the unit sales and active listing for specific areas in British Columbia.

With an increased number of sales, a consequent decline in the active listings is visible for the months of October and November. As inventory clears out and new listings come in, the market is gradually shifting toward a Seller’s market – a trend which is becoming visible across Canada housing market.

The locations of British Columbia mentioned in the figures experienced growth in both average prices and sales compared to last year. Let’s take a quick look at how the Fall 2024 surge has impacted the housing market in these regions.

The Greater Vancouver Area (GVA) has become a hot spot for homebuyers. People are drawn to the area because of its strong economy, great lifestyle, and lots of job opportunities. GVA saw a magnanimous jump of over 40% in its sales in October 2024 in comparison to September 2024. Although November saw 17% decrease month-over-month, sales numbers remained strong with nearly 2200 sales. The average prices in the GVA remained around CAD 1,275 k which is ~1% decline year-over-year.

Victoria

Victoria’s real estate market continues to be robust, with consistent demand driven by its mild climate, vibrant economy, and scenic beauty. Buyers include retirees, professionals, and investors, contributing to rising property values despite an increase in listings. Although November sales were down by around 13% month-over-month, they were at a significant 41% increase YoY with average prices seeing a nearly 3% decline YoY to end up close to CAD 980k.

Chilliwack

Chilliwack’s market shows a mix of increasing home prices and strong sales, driven by its proximity to Vancouver and growing appeal for families seeking more space and affordability compared to urban centers. Average price in Chilliwack saw and over 0% increase YoY to CAD 768k in November with sales numbers seeing a 25% boost YoY.

BC Northern

The market in BC Northern remains more affordable compared to southern regions, with steady demand for detached homes and a balanced market trend. The area continues to attract buyers looking for larger properties and outdoor lifestyles. The average prices closed at around CAD 420k with an almost 6% YoY increase.

Fraser Valley

The Fraser Valley has seen strong buyer interest, with suburban appeal growing as families and first-time buyers continue to prioritize affordability and lifestyle. The average prices in November were approximately CAD 1,032k which is an over 4% YoY jump.

Powell River

Powell River offers a quieter, more affordable alternative to major BC cities, appealing to retirees and remote workers. While prices have softened slightly, the market remains stable, supported by demand for waterfront properties and a relaxed lifestyle. Average residential prices in Power River were around CAD 650k with a 26.3% increase YoY.

A Fall Review for real estate and homes in British Columbia…

The real estate market in British Columbia showed surprising strength in October and November, with October leading the way for a surge in activity. This boost in sales was driven by more available inventory and the Bank of Canada’s interest rate cuts, which encouraged buyers to act. Year-to-date sales show steady growth, confirming the province’s strong real estate market. While December is typically slower, the outlook for the end of 2024 and early 2025 is still promising. As economic conditions continue to evolve, the market could remain active through the end of the year, shaping what’s to come in 2025.