Canada’s real estate market has undergone a dramatic transformation in recent years. Once characterized by rapid price appreciation and fervent competition, the market is now experiencing a period of adjustment. This article delves into the key factors that have shaped the housing landscape, examining both the exhilarating ascent and the subsequent recalibration.

The Rollercoaster Begins: 2023 Onwards

As noted earlier, the once-feverish pace of the Canadian housing market began to cool in 2023. The Bank of Canada’s decision to increase interest rates to combat inflation was a pivotal moment. This policy shift had a profound impact on affordability, deterring potential buyers and tempering demand. Consequently, the balance of power shifted from sellers to buyers, leading to a more balanced market.

However, it’s essential to recognize that this shift has not been uniform across the country. While some regions experienced more pronounced cooling, others maintained a steady or even upward trajectory. Understanding these regional disparities is crucial for grasping the full complexity of the Canadian housing market.

Regional Dynamics: A Diverse Picture

Canada’s vast geography and diverse economic conditions have resulted in a patchwork of housing market performances. Major urban centers like Toronto and Vancouver, once synonymous with skyrocketing prices, have undergone significant corrections. The influx of foreign investment and speculation, coupled with restrictive housing policies, contributed to these cities’ meteoric rise. Nevertheless, the impact of rising interest rates and economic uncertainty has led to a more subdued market.

In contrast, smaller cities and provinces, such as those in the Atlantic region, have experienced more moderate price growth. These areas have benefited from a relatively lower cost of living, increased remote work opportunities, and a steady influx of newcomers.

Price Trends Across Canada (2023-2024)

The Canadian Real Estate Association (CREA) provides a valuable resource for tracking national and regional housing price trends. Their National Price Map allows users to visualize average home prices across Canada, with data available for different time periods.

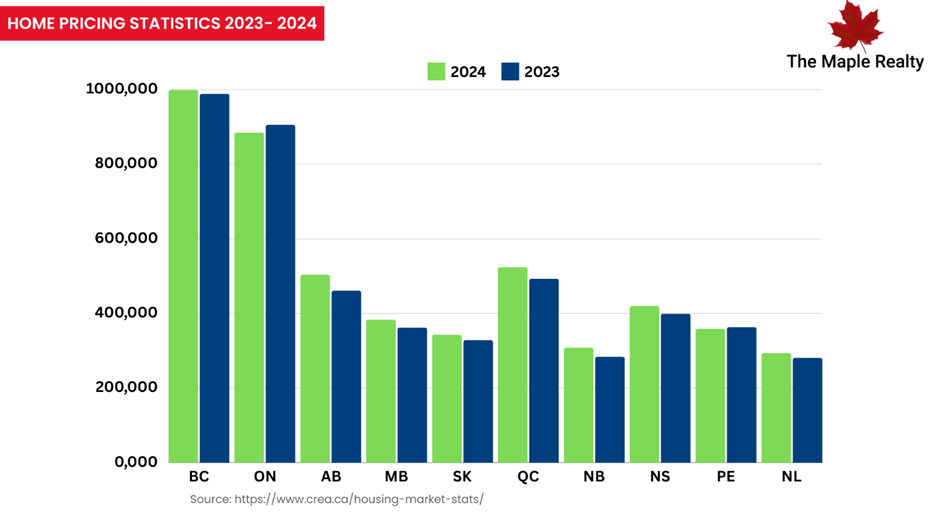

The data obtained from Canada Real Estate Association (CREA) for the years 2023 – 2024 shows the average home prices (in C$) for the provinces of British Columbia, Ontario, Alberta, Manitoba, Quebec, and Nova Scotia. Benchmark prices are shown for Saskatchewan, New Brunswick, Prince Edward Island, Newfoundland & Labrador.

As seen in the image, some regions experienced significant price fluctuations between 2023 and 2024. However, almost all provinces have seen a slight (if not significant) increase in the prices.

Ontario is the only province where the average prices have observed a decrease in property sales. Looking at this drop year-over-year (YOY), the average home selling prices have dropped a significant 4.3% from 2023. Furthermore, the average selling price of single-family homes in Ontario has declined 4.1% YOY; prices of townhouses/multiplexes has decreased by 3.4%; prices of condos have decreased 4.4% YOY. The only factor seeing an increase is the rent – which has increased by 1% YOY.

It is interesting to note that in British Columbia, the benchmark housing price has observed a decrease YOY of 0.9%. Now the average home prices have observed an overall 1% increase year-over-year. Different cities in the province have observed variations as well.

Challenges and Opportunities

The evolving Canadian housing market presents both challenges and opportunities for various stakeholders. Homebuyers, once faced with fierce competition, now have more options and potentially greater negotiating power. However, the increased cost of borrowing remains a hurdle. Sellers may need to adjust their expectations to align with the new market realities.

Investors, too, must adapt to the changing landscape. While the potential for quick profits may have diminished, opportunities exist for those with a long-term perspective. Diversifying investments across different property types and regions can help mitigate risks.

Emerging Trends and Future Outlook

As the Canadian housing market navigates this period of transition, several emerging trends are shaping the landscape. One notable development is the increasing emphasis on sustainability and energy efficiency. Homebuyers are becoming more conscious of environmental impact and are seeking properties that align with their values. This shift is driving demand for green homes and energy-efficient renovations.

Furthermore, the rise of remote work has altered housing preferences. With the flexibility to work from anywhere, many people are seeking larger homes in suburban or rural areas to accommodate home offices and enjoy a better quality of life. This trend has implications for urban housing markets, as demand for downtown condos may decline while suburban housing becomes more desirable.

Technology is also transforming the real estate industry. Virtual tours, online property listings, and AI-powered tools are enhancing the home buying experience. Additionally, proptech companies are developing innovative solutions to address challenges such as housing affordability and market transparency.

While the Canadian housing market has faced headwinds in recent years, the long-term outlook remains positive. The country’s strong economy, growing population, and continued demand for housing are fundamental drivers of market growth. However, ensuring housing affordability and addressing supply constraints will be crucial for maintaining a healthy and sustainable market.

In conclusion, the Canadian housing market is in a state of flux, but it also presents opportunities for adaptation and innovation. By understanding the emerging trends and challenges, industry stakeholders can position themselves for success in the years to come.

Sources:

https://wowa.ca/bc-housing-market

https://www.statista.com/outlook/fmo/real-estate/canada?currency=CAD

https://financialpost.com/real-estate/canada-housing-market-sees-surge-listings

https://www.crea.ca/housing-market-stats/canadian-housing-market-stats/national-price-map/